How Does Buy Now, Pay Later (BNPL) Work?

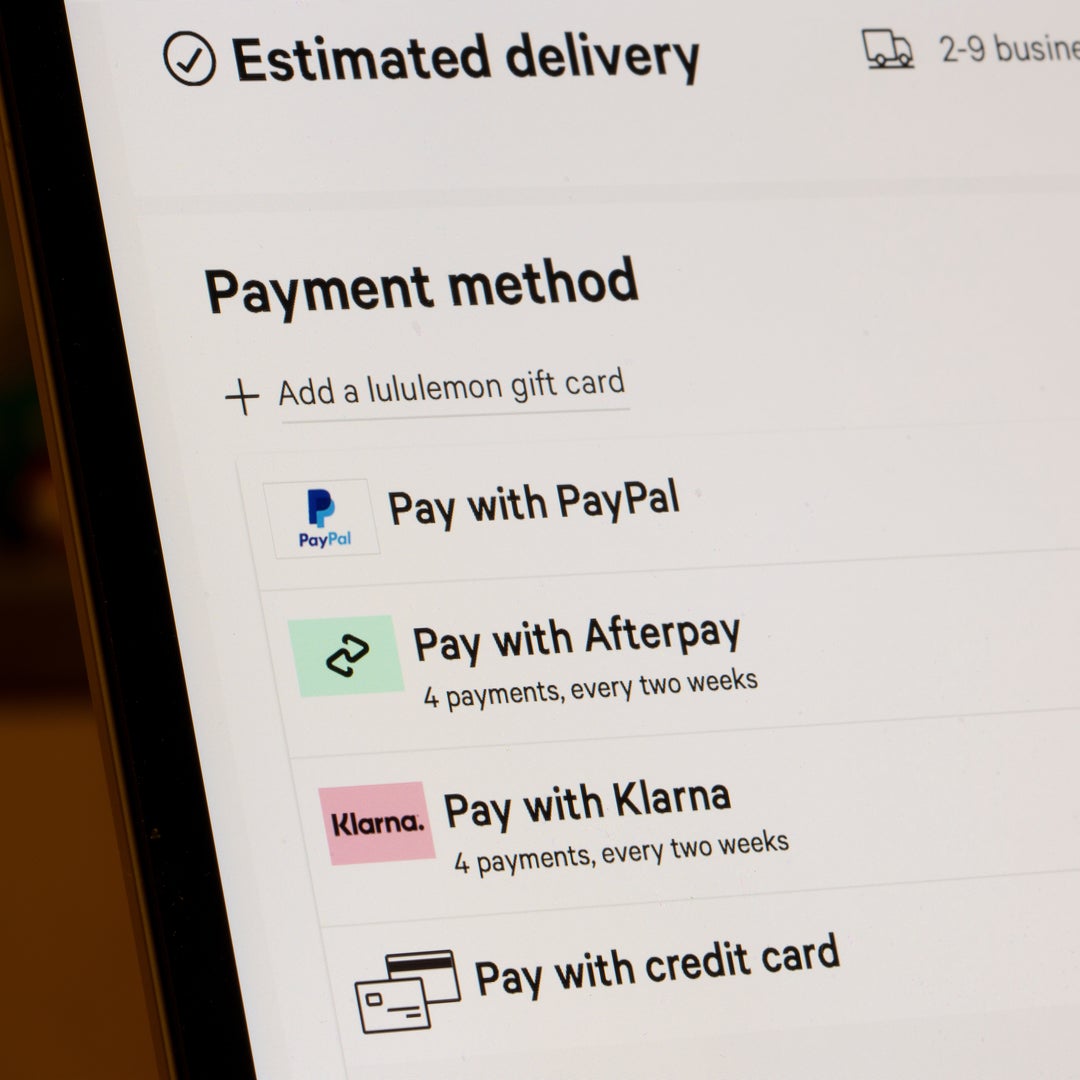

“Buy Now, Pay Later” services, such as Affirm, Afterpay, and Klarna, are gaining popularity with Americans — a whopping 74% of shoppers say they have used them, according to a Breeze Survey of 1,500 Americans from January 2022.

Unlike buying on layaway, where you set up a payment plan and get the product after you’ve paid the full amount, these services allow you to take the product home now, or buy it online, while only paying for part of it upfront.

Some stores like Walmart have gotten rid of layaway altogether and replaced it with a BNPL service.

“It is sexy to think you can get something that you can’t afford,” says Mark La Spisa, a certified financial planner and president of Vermillion Financial. “That’s the illusion that is going on.”

This illusion is costing some Americans significantly. More than half (57%) of Americans said the service caused them to spend outside their means. And 36% of users said they missed or made a late payment, which can sometimes result in late fees.

The Consumer Financial Protection Bureau is even probing BNPL companies Affirm, Afterpay, Klarna, PayPal, and Zip about the risks of their offerings. Because these services are so easy to use, the CFPB is concerned it will lead consumers into more debt.

There are ways to use BNLP services without ending up in long-term debt, though. Here’s how, according to money experts.

Look up service fees charged by BNPL companies

“It’s vital that consumers understand the services they are using,” Kristin McGrath, a shopping expert at RetailMeNot told Grow. “Some involve interest, some involve fees, and there are also various late-payment penalties.”

A quick Google search of the BNPL service name and the word “interest” or “fees” can lead you to the information you need.

Affirm, for example, can charge interest rates up to 30%, based on your credit. Afterpay doesn’t charge interest but does have a late fee of up to 25% of the purchase for US shoppers.

‘Utilize a cooling off period’ between shopping and buying

It’s good to remember that companies have entire teams dedicated to finding out how to get you to buy things you don’t need. “People on Madison Avenue are experts at finding out how to separate people from their money,” La Spisa says.

So before buying something either online or in-store, wait 24 hours. In many cases, he says, people won’t go back and buy something they don’t absolutely need.

“If something is expensive, you want to utilize a cooling off period to see whether it’s really something you want and you’re not just getting hooked on the marketing message,” he says.

Ask yourself some questions

If you are having a hard time deciding whether a purchase is worth it, ask yourself a few questions, La Spisa says.

-

“Does it fit into my budget?” Let’s say you have $100 of discretionary spending per month after you’ve paid your bills and contributed to your savings. If your payment is $50, that is 50% of your discretionary spending for the month. Knowing that, evaluate whether it’s a smart purchase.

-

“How will it make a difference in my life?” Think about whether you’ll want this item in six or three months, or even in one month. If the amount of time you’ll spend making payment exceeds the amount of time you’ll enjoy the item, it might not be a good buy.

-

“What else would I use the money for?” “Money decisions don’t operate in a vacuum,” La Spisa says. If the money would be going toward an emergency fund or retirement plan, evaluate whether you need this item more than you need to contribute to either of those funds.

Use buy now, pay later for big ticket items

Using a BNPL service might seem like a good way to stretch your dollar for now. Still, remember that you will eventually have to pay for everything in full.

“To use these programs safely, shoppers might consider putting a planned, budgeted-for, big-ticket purchase on a ‘buy now, pay later’ plan to give themselves some breathing room,” McGrath says. “But putting a slew of impulse buys on these plans throughout the season can get dangerous.”

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Article contributors are not affiliated with Acorns Advisers, LLC. and do not provide investment advice to Acorns’ clients. Acorns is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.