What is Inflation?

When your parents bought gasoline for their car in 1975, can you guess how much they paid? A gallon of gas cost just 57 cents. Today, you’’ll likely pay more than $3 per gallon. One of the primary drivers behind the steep price difference is inflation.

But what is inflation? It’s a term that refers to a sustained increase in prices for goods and services. Inflation can significantly affect your budget because it lessens how far your money can go.

Understanding how inflation works and what you can do about it may help reduce its impact on you.

What is inflation?

The Federal Reserve, which is the central bank of the United States, defines inflation as a widespread rise in the price of goods and services in the economy over time.

When measuring inflation, the Federal Reserve doesn’t look at the price changes of one product or industry. Instead, Federal Reserve policymakers monitor indexes that track the price changes in a basket of goods and services in the economy.

One of the most commonly used indexes is the Consumer Price Index (CPI). This index measures the average change over time in the prices paid by urban consumers for essentials like utilities, fuel and food. You can view the most recent CPI and find out how it’s changed by visiting the Bureau of Labor Statistics website.

Understanding inflation rate

The inflation rate isn’t fixed; it can rise and fall from month to month. Some level of inflation is to be expected.

The Federal Reserve aims to maintain an inflation rate of 2%. That percentage is what economists and policymakers consider to be a healthy rate of inflation. It allows the economy to steadily grow, and families can still afford to save and make informed decisions about borrowing and investing money.

However, inflation can get out of control. When inflation is too high, people don’t have as much money to spend and money to save, and businesses may have to make cuts to their staffing and manufacturing.

Inflation rate formula

To calculate the rate of inflation, use this formula, where “A” is the original cost of a good or service — or an index of baskets of goods and services — and “B” is the current cost:

((B-A)/A) x 100

1. Subtract the original cost from the current cost to calculate how much the price has changed.

2. Divide the result by the original cost to get a decimal number.

3. Multiply the decimal number by 100 to get a percentage; that result is the inflation rate.

For example, consider the change in the cost of gasoline. As mentioned above, a gallon of gasoline was just 57 cents in 1975. The average cost in early 2023 was about $3.50. To calculate the inflation rate, plug those numbers into the formula:

[($3.50-$0.57)/$0.57] x 100

The result shows that gasoline prices have increased by 514% since 1975.

What causes inflation?

Now that you know what inflation is and how it can impact you, you may be wondering what causes inflation to increase in the first place. Several factors can lead to increased inflation, but economists cite three core drivers:

Demand-pull

Demand-pull inflation occurs when the demand for goods and services increases at a faster pace than the supply can handle. Demand may rise for several reasons, including higher consumer spending, rising wages, and government policies — such as tax credits and stimulus checks — that increase the money supply. As a result, businesses increase prices to try and curb that demand, which pushes up the cost of living.

Cost-push

Cost-push inflation is caused by higher production costs. When businesses face higher costs for raw materials, fuel, energy or labor, their profits are slashed. To compensate, businesses raise their prices — and overall prices across the country eventually increase, too.

Devaluation

Devaluation is when a currency, such as the U.S. dollar, loses its value compared to other currencies. Because the value of the dollar drops, the cost of importing materials from other countries is more expensive. The higher cost is passed on to consumers in the form of higher prices. It can also cause uncertainty about the economy and lead to higher inflation.

Why is inflation so high?

As of February 2023, prices across the CPI increased by 6% over the preceding 12 months. That rate is quite higher than the Federal Reserve’s 2% target, but it’s still an improvement over past inflation rates; for example, in June 2022, inflation was over 9%. Here are some of the main reasons inflation has increased:

Supply-chain issues

During the COVID-19 pandemic, many countries shut down their manufacturing centers so workers could stay home. That measure caused major global supply-chain issues, and companies couldn’t get some of the raw materials or supplies they needed to make the products consumers wanted.

Labor shortages

During the pandemic, many companies couldn’t recruit enough workers to fill open positions. The labor shortages, coupled with supply-chain issues, reduced output. And as a result, many companies couldn’t keep up with consumer demand.

Raised prices

To cope with the supply chain and labor issues, many industries hiked their prices. With limited supply, the price increases were quite steep. For example, the price of a new car in 2023 averaged $46,437. By contrast, the price of a new car in early 2019 averaged just $33,267.

Cash windfalls

Some policymakers and economists say government measures, like stimulus checks and the student loan payment freeze, negatively impacted the economy and drove up inflation. These measures gave cash windfalls to consumers, which they suggest caused the demand for goods and services to outpace the supply.

Interest rate reductions

During the pandemic, the Fed slashed interest rates, making it more affordable for people to borrow money to buy cars or houses. But with the interest rates on mortgages and auto loans reaching historic lows, there was increased demand for houses and cars, causing prices to soar.

Inflation rate by year

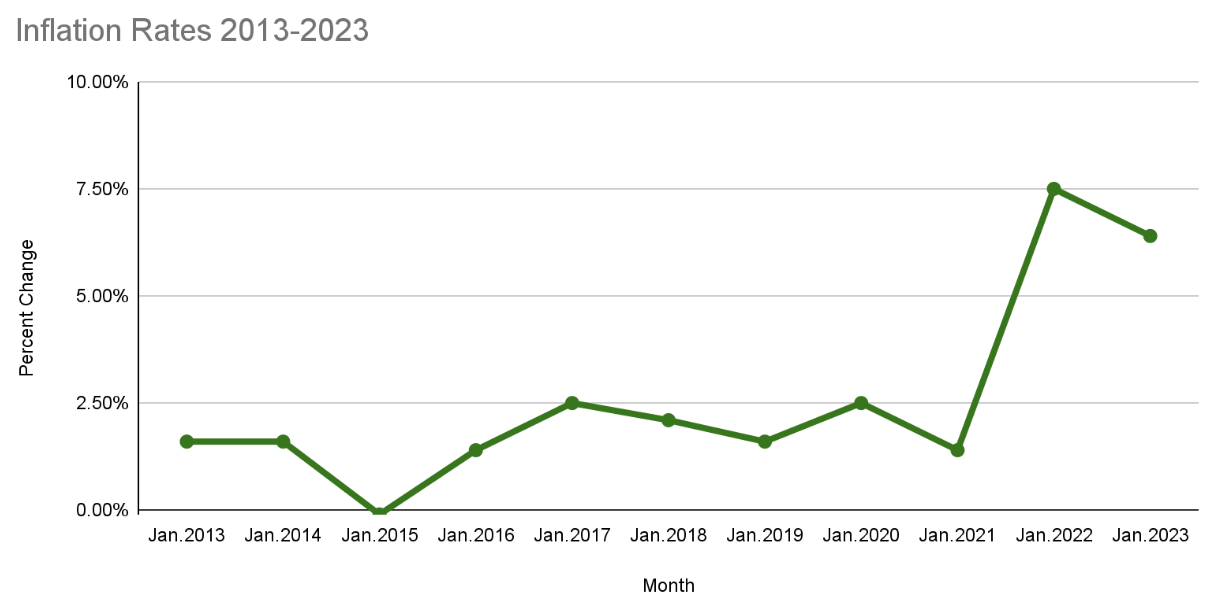

Between 2013 and 2020, inflation rates were relatively low and the Fed was able to maintain rates near its 2% target. But rates began to increase in 2021 and reached record highs in 2022.

To give you an idea of how the rates fluctuated over the past decade, here’s a snapshot of the rates in January of each year.

How does raising interest rates help inflation?

When inflation gets too high, the Fed may hike its benchmark rate, which is called the federal funds rate. Banks and other lenders use this rate as a guideline, so those rate hikes are passed on to consumers. It makes it more expensive to borrow money in the form of mortgages, car loans and even credit cards. Higher rates can slow economic growth and potentially temper inflation.

Inflation vs. recession

Inflation and recessions are connected, but they’re separate economic concepts. The National Bureau of Economic Research defines a recession as a consistent decline of gross domestic product that lasts for several months. Recessions are a normal part of the economic cycle, and they typically occur after periods of economic growth.

Recessions are linked to inflation. Rising inflation may cause the Fed to raise its benchmark rate — but as a consequence, the economy slows down, and there is an increased risk of entering a recession. However, recessions are relatively brief. Recessions last for about 10 months on average.

What is the Inflation Reduction Act?

The Inflation Reduction Act was signed into law by President Joe Biden in August 2022. The federal law was designed to reduce inflation through several key measures. The bill allotted $500 billion in new spending and tax breaks to accomplish the following:

Tax revenue

The new law increased the minimum tax on major corporations to raise revenue for the government. Combined with other initiatives, the bill is expected to lower the federal budget deficit, which could help reduce inflation.

Health care costs

The bill aims to reduce health care costs by allowing Medicare to negotiate prescription drug prices with the companies that manufacture them. The bill also extended tax credits associated with the Affordable Care Act for another three years. The aim is to slow the rise of inflation by reducing the costs of a major expense for millions of Americans.

Clean energy

The bill also contains dozens of clean-energy incentives such as tax breaks, grants and loan guarantees. Measures like buying electric vehicles, installing solar panels and using energy-efficient heat pumps can help individuals and companies save money while addressing climate change. These tax credits and deductions may lower household spending on gas and electricity bills, with the goal of limiting inflation.

How to stop inflation

Stopping — or even slowing — inflation has to come from the federal level, but it’s a hotly debated topic among policymakers and economists. The U.S. Congress Joint Economic Committee Republicans recommended the following steps to slow the inflation rate:

Deregulation of energy, housing and other markets

Decreasing regulations on energy, housing and other industries could reduce business costs, causing them to reduce prices.

Removing barriers to work

Steps like reforming occupational license requirements and reducing or eliminating certain tax breaks may encourage workers to return to the labor force.

Reduce government spending

The committee suggested that reducing the amount of money the government spends would slow demand and increase confidence that the federal government can manage its budget and pay down the deficit.

How could inflation affect me?

Inflation can seem like a very abstract concept, but rising prices will directly impact your everyday spending. As inflation increases, you’ll find that your paycheck doesn’t go as far as it once did because everything is more expensive.

For example, let’s say you earned an annual salary of $40,000 from your job in 2017. Thanks to inflation, you’d have to earn $48,419.60 in 2023 to have the same buying power. That’s a 21% difference in salary. If your salary hasn’t increased, though, you may have to trim your budget or look for other sources of income to maintain the same standard of living.

You can use the inflation calculator to see how inflation affects your income and cost of living.

How to prepare for inflation: 3 tips

If you’re worried about inflation, you can protect yourself with the following measures:

1. Move your money to a high-yield savings account

Typical savings accounts pay very low annual percentage yields (APYs). But with a high-yield savings account, you can earn much more interest on your money.

2. Look for areas to cut from your budget

Periodically review your bank and credit card statements and look for expenses you can trim. Canceling unused streaming services and app subscriptions are common ways to save money.

3. Continue to invest

To combat inflation, you need the stock market to do some of the hard work for you. Although the stock market can fluctuate, it has historically provided returns that outpace inflation rates. And with Acorns Invest, you can invest for your future with investment portfolios tailored to your needs.

This material has been presented for informational and educational purposes only. The views expressed in the articles above are generalized and may not be appropriate for all investors. The information contained in this article should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. There is no guarantee that past performance will recur or result in a positive outcome. Carefully consider your financial situation, including investment objective, time horizon, risk tolerance, and fees prior to making any investment decisions. No level of diversification or asset allocation can ensure profits or guarantee against losses. Article contributors are not affiliated with Acorns Advisers, LLC. and do not provide investment advice to Acorns’ clients. Acorns is not engaged in rendering tax, legal or accounting advice. Please consult a qualified professional for this type of service.